A Deep Dive Into M&A Deal Leaks and Board Diversity Trends

29 November 2023For the first time, our annual research examines the impact of gender diversity on deal leaks.

Despite the stringent regulatory oversight and insider trading laws governing financial markets, mergers and acquisitions (M&A) deal leaks still happen both intentionally and unintentionally. A noticeable uptick in trading activity in a target company's shares before a public M&A bid announcement often indicates insider knowledge, with market parties aiming to capitalize on the anticipated bid premium.

In an ever-changing dealmaking market, SS&C Intralinks and the M&A Research Centre at The Bayes Business School, City, University of London, collaboratively conduct annual research to analyze the current state of deal leaks globally, regionally and by sector.

This year's research takes a notable step by examining the impact of gender diversity on deal leaks for the first time. To learn more about this year’s findings, we spoke with Dr. Valeriya Vitkova, senior research fellow and course director at Bayes Business School.

SS&C Intralinks: You’ve led the research for our collaborative annual deal leaks study since its inception. This year’s study is unique because it looks at gender diversity in the context of deal leaks at both the executive and non-executive level of public targets between 2008 and 2022. Could you provide some insight into why you chose to investigate this aspect?

Dr. Valeriya Vitkova: There is a growing body of literature analyzing whether corporate outcomes can be positively influenced by higher levels of gender diversity in the boardroom. Studies show that more gender-diverse boards are associated with less frequent and less severe securities fraud, fewer environmental sanctions, lower tax avoidance and lower rates of account misreporting.

PODCAST: Research Examines the Impact of Gender Diversity on M&A Deal Leaks

Another key motivating factor for me relates to the reasons why greater gender diversity can lead to more positive outcomes. We can think of three contributing factors that have been highlighted by prior studies:

- One key factor is that greater gender diversity can help to improve the monitoring function of the board of directors (BoD). For example, studies show that there is improvement in fundamental board functions, such as attendance of meetings, or the quality of discussions that take place as well as the ability to have better monitoring of the disclosures and reports that a given company produces. There is also some evidence that women can be more risk-averse and less overconfident and this can improve the monitoring function of the BoD. Past studies show that there are unequal levels of discipline being applied to male and female employees. For example, studies show that female employees who are responsible for missteps are subject to stricter penalties than their male counterparts.

- The second key factor relates to the idea that having greater gender diversity at the senior leadership level can help to improve the skills and expertise of the management team. Specifically, having more women in the boardroom can help to bring a broad range of views, opinions and skills to the decision-making process. Some studies show that more diverse management teams can be more innovative and creative, they can be more open to different ideas, and they can be more willing to consider a broader range of alternatives when it comes to addressing different situations.

- The third key factor is related to the idea that women can be more stakeholder-oriented. This could be because historically women have been taught different types “appropriate behavior” and there are certain personality characteristics that may typically be associated with women such as being caring, compassionate, and attentive to the needs of others. In the context of corporate management, this can translate to greater attention to the needs of shareholders, employees and customers. For example, studies show that women are less likely to be driven by personal motivations such as empire-building when they engage in M&A activities.

Can you share some initial insights into the relationship between gender diversity at the board level of public targets and deal leaks? Are there any overarching trends or patterns that emerged from your analysis?

I would divide the trends into two parts:

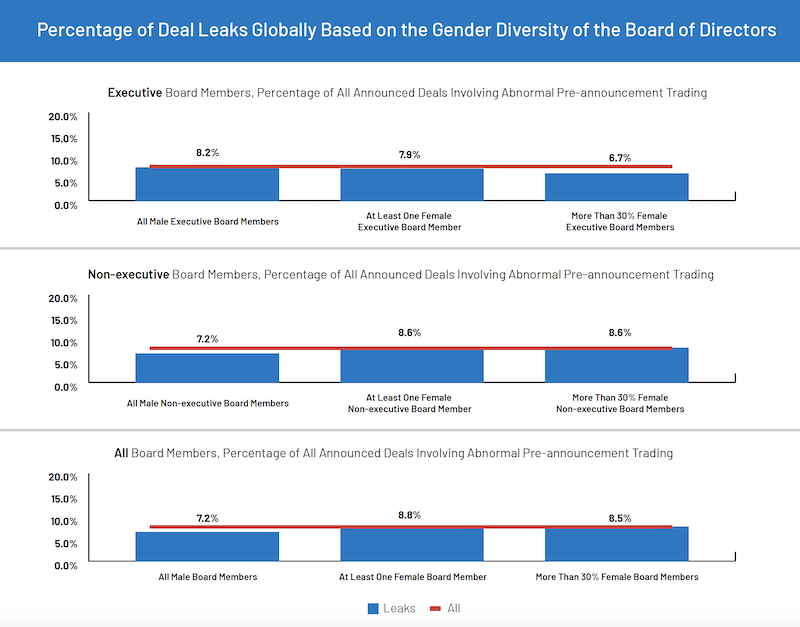

Incidence of M&A leaks: One of the most striking findings of our analysis is that deals involving targets with greater gender diversity at the board level are associated with lower incidence of abnormal pre-announcement trading. This observation appears to be driven particularly by greater gender diversity at the executive (as opposed to non-executive) board member levels. We find that targets with more than 30 percent female executive board members experience approximately two percentage points lower incidence of leaks (8.6 percent vs. 6.7 percent).

It is important to note that optimal outcomes in terms of lowest incidence of M&A deal leaks are observed when the proportion of both executive and non-executive female board members are higher. We find that the incidence of deal leaks is as low as 3.2 percent for target firms where both female executive and female non-executive directors are above 30 percent.

This finding is very interesting because it relates to a concept that is referred to as critical mass in prior academic studies. This idea suggests that female directors can be more influential if they reach a certain level of ‘critical mass’ such as at least 30 percent female board members. Having one or two female directors who are treated as symbolic figures and elected to be BoD to account for their social category, is unlikely to result in positive outcomes. This is sometimes referred to as the token female director and, unsurprisingly, such low levels of gender diversity are unlikely to make a significant difference to corporate outcomes and this is supported by studies in this area. Women are able to add value once they reach a critical mass of three or more, for example.

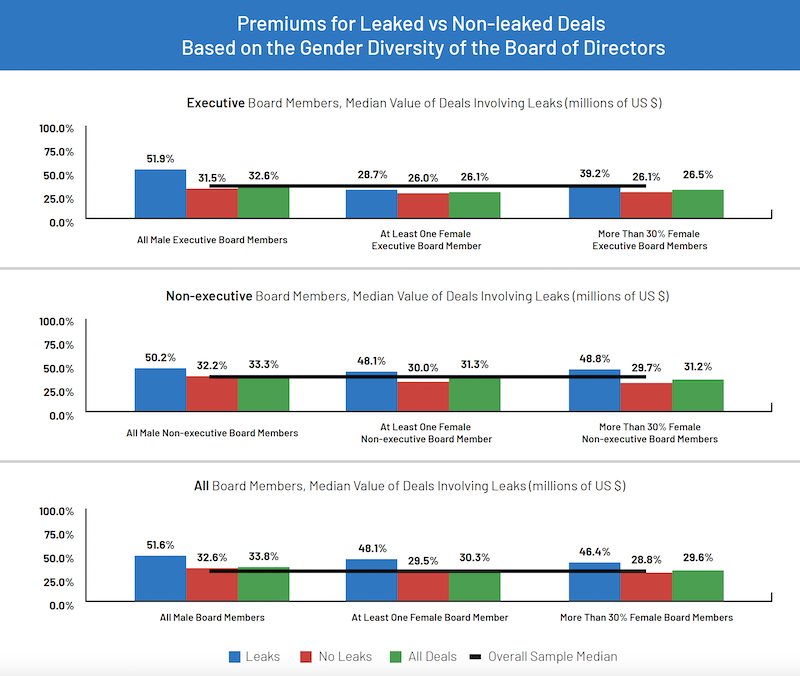

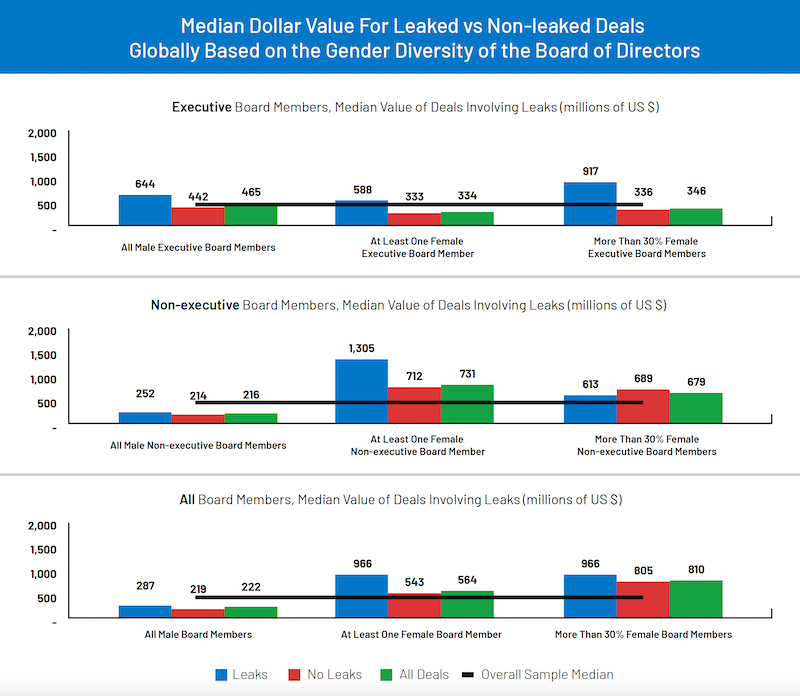

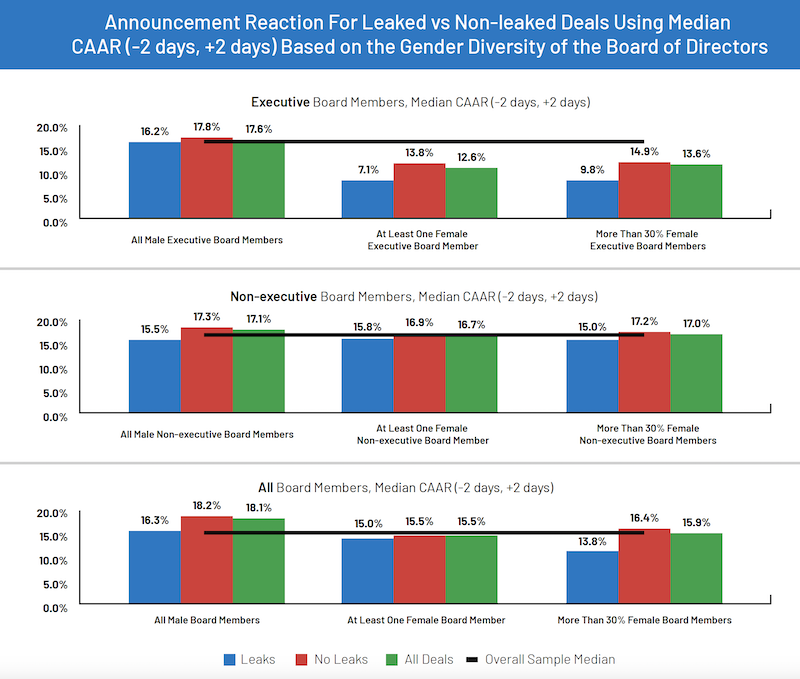

Completion rates and deal premiums: We found that completion rates are the lowest and deal premiums highest1 for targets in leaked deals where both the proportion of female executive and non-executive directors is above 30 percent. Specifically, completion rates and premiums are at 33 percent and 58 percent, respectively, for targets with more gender-diverse boards compared to completion rates and premiums amounting to 84 percent and 53 percent, respectively, for targets with all-male boards. It is possible that targets with greater female board representation are less willing to accept leaked bids due to the negative association with market abuse and misconduct surrounding M&A leaks. At the same time, this could motivate bidders to offer relatively higher premiums in order to persuade these target firms to accept a given M&A offer in the interest of maximizing shareholder value. This interpretation is consistent with the idea that misconduct is less prevalent in firms with greater gender diversity.

We noted that the targets with greater female board representation are larger on average compared to the targets with all male board members and this could help to explain some of the results discussed above.

Did you identify any potential causal factors or correlations between the gender diversity of boards and deal leaks trends?

Establishing a causal relationship between board gender diversity and M&A leaks is challenging. For example, female executives could be more likely to choose to work for companies that are less likely to be subject to misconduct. We must also keep in mind the fact that the number of M&A deals involving leaks is a small proportion of all M&A deals involving public targets. The sample size becomes even smaller when we impose the condition that we have information about the degree of gender diversity at the board level. As a result, our ability to examine trends in deal leaks and female representation over time has been very limited. We focus on interpreting the associations that emerge from our analysis without making any definitive conclusions about cause and effect.

How did the addition of gender diversity data impact our understanding of deal leaks and their implications?

Our analysis suggests that greater gender diversity at the board level could help to increase the effectiveness of board monitoring. This can therefore help to improve the board’s ability to reduce the likelihood that information about a given M&A deal is leaked. Prior studies also provide evidence that greater female representation could help to enhance the monitoring skills and expertise of the board in areas other than deal leaks, such as financial disclosure.

Let’s get to the global results. Deal leaks were at the same level in 2022 compared to the previous year. Why do you think this is so?

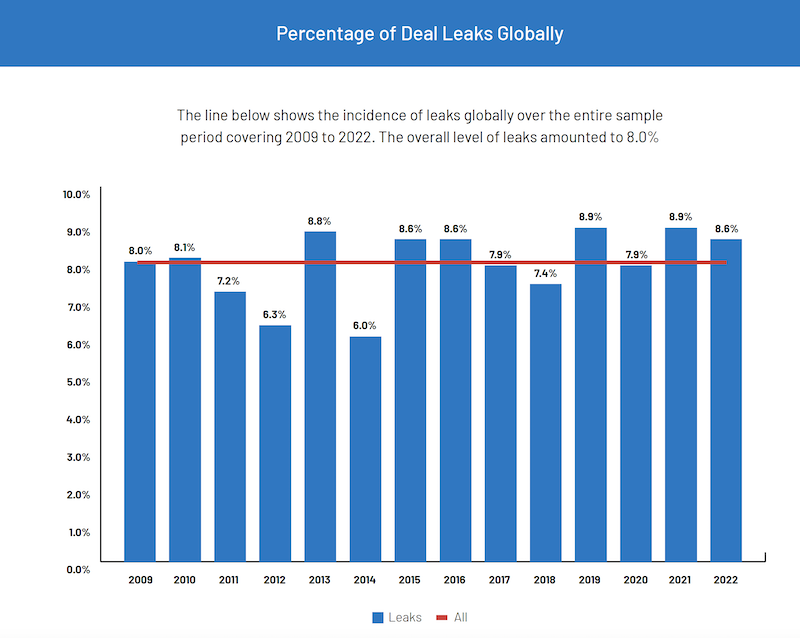

Globally, M&A deal leaks in 2022 remained broadly at the same level as the year before: 8.6 percent of all deals announced in 2022 involved a leak compared to 8.9 percent of all deals announced in 2021. The fact that the overall incidence of deal leaks has remained roughly at the level of between eight percent and nine percent since 2009 could suggest that the actions taken by regulators since that time to prevent deal leaks have not been fully effective. Of course, we need to acknowledge that some deal leaks are unintentional — they are accidents or they happen by mistake. However, we cannot assume that all the M&A leaks that we observe on an annual basis are unintended. It is also important to note that the stable global levels of deal leaks disguise some interesting differences at the regional, country and industry level.

France (22.2 percent), South Korea (12.8 percent) and Japan (11.5 percent) were the three countries with the highest leaked deal activity in 2022.

The ranking of countries in terms of rates of M&A deal leaks can vary from one year to the next. If we take the period since the inception of the annual leaks study in 2019, we find that the leakiest countries are Hong Kong, South Korea and India. Such differences in the number of leaked deals may be of particular interest to regulatory bodies in the relevant countries. Our findings of increased leak activity may highlight the need for increased regulatory measures and market monitoring to help minimize the degree of market misconduct.

It is important to note that the number of deals involving public targets in some of these countries is relatively low when looked at on an annual basis. Out of the top three leakiest countries, France has relatively lower public target deal volumes in 2022. As a result, small changes in the number of deals with leaks can lead to relatively larger swings in the statistics that we observe.

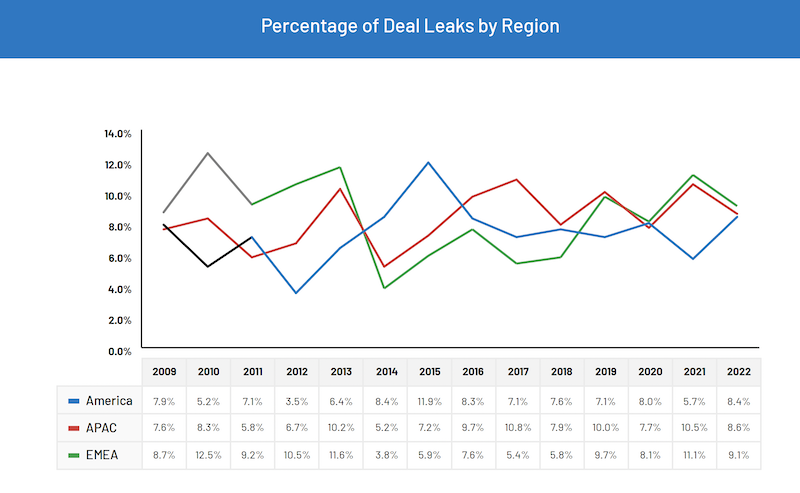

While leaks decreased in APAC and EMEA, the Americas was a different story. What’s your thesis on the significant increase in the Americas?

In 2022, North America was the leading region globally in terms of M&A deals. Higher levels of deal activity and the resulting higher competition for targets in these regions could be driving these trends. In addition, cultural factors and the way business is done in some of these markets could be contributing to different rates of M&A leaks at the country and regional level. These markets are also regulated differently and the perceived threat of being caught in an insider trading scandal, for example, may not be as high among certain market players. But that being said, a high level of perceived or even actual insider trading is a factor in regulators “getting tougher,” and that’s something that we saw about a decade ago in the U.K. which had had a much higher level of “leakiness” than currently. The trends in the U.K. can at least partly be attributed to regulators getting tougher.

Let’s talk about sectors. Retail (24.3 percent), TMT (11.4 percent) and Industrials and Healthcare (10.8 percent) were the sectors with the highest pre-announcement abnormal trading in 2022. Why do you think these sectors are traditionally leaky?

These sectors registered relatively higher growth in M&A volumes in 2022, with deal volumes in the retail sector experiencing a 20-year high, for example.

Companies are increasingly looking to improve their environmental, social and corporate governance (ESG) performance through strategies involving M&A. For example, in the retail sector, we have seen an increased focus on sustainable supply chains, healthy eating, ethical workforce practices and plant-based ingredients. Technology is another major driver of deal volumes, with companies looking to develop their e-commerce capabilities with direct-to-consumer channels. Companies in the retail space are increasingly looking to restructure their business portfolios to adapt to consumer demands that are continuously evolving.

In the TMT sector, factors such as digitalization and the need to innovate and adapt to emerging AI technologies are among the key causes of relatively higher deal volumes. In the industrials sector, companies are increasingly utilizing M&A deals to build capabilities in the areas of AI, robotics, automation, cybersecurity and data analytics. Acquisitions in the industrials sector are also enabling companies to address ESG goals and to moderate supply chain uncertainty through nearshoring.

All three sectors experienced an increased interest from acquirers and higher levels of competition for targets, which can also result in more intense publicity and media coverage relating to these sectors. In these situations, targets may be tempted to use leaks to increase the chances that the deal closes successfully, speed up transaction closing times and boost offer premiums. This is particularly true if you are a high-quality target and an M&A deal leak can provide you with an opportunity for a final push to increase the deal premium and increase your ability to shape the terms of the M&A deal in your favor. Even the existing threat that a deal leak could attract competing buyers may be enough to convince bidders to offer a higher premium or work harder towards closing the deal sooner.

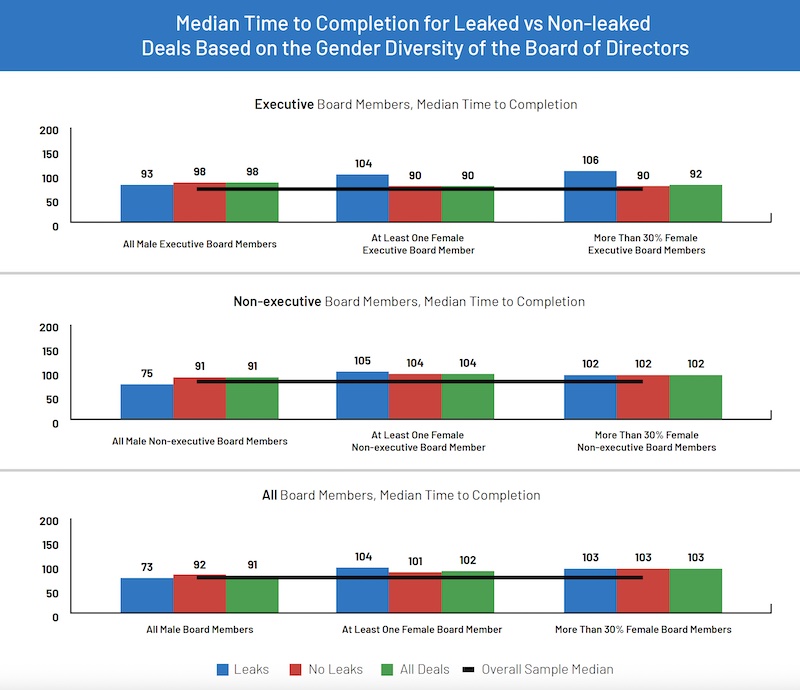

Leaked deals took a shorter time to complete (median of 80 days) compared to deals without a leak (median of 94 days) in 2022. What are the potential reasons for this discrepancy in completion times? Are there any factors that might be contributing to this trend, and do you expect it to continue in the coming years?

From the acquirer’s perspective, faster time to completion could be due to the threat or presence of competing bidders. M&A leaks increase the market awareness of a given M&A deal and this can make competing offers more likely. In a competitive bidding environment, the likelihood of having to pay a higher price or being unsuccessful is higher. From the target’s perspective, a longer time to deal closure — and therefore a longer due diligence process — can increase the chances of the acquirer discovering issues that make them unwilling to complete the transaction or, issues that provide them with greater bargaining power in the deal negotiation process. As a result, targets may also have an incentive to speed up the M&A process.

Overall, what are the key takeaways from the research dealmakers should know as they begin to plan for 2024? Which methods can deal teams employ to make sure deals aren’t accidentally leaked?

More active enforcement of regulations can be crucial to reducing leak activity. This is demonstrated by the U.K.’s experience of achieving consistently lower levels of M&A leaks compared to the levels that were observed a decade ago.

Companies can also implement measures to reduce the likelihood of M&A leaks. Managing M&A leaks starts by setting the tone at the top, right from the senior leadership team. Our analysis shows that greater gender diversity in senior leadership positions can be one effective way to achieve this. Other measures include careful drafting of NDAs and other contractual agreements between the target, acquirer and other parties to the M&A process. The adoption of penalty clauses, advisor fee impact, and lower purchase price clauses can be incorporated into the transaction engagement terms as leak deterrents. In addition, bidders and targets can adopt processes and technologies that allow for the effective control of access to information during the M&A process, such as we see with the increasing use of virtual data rooms (VDRs), secure communications and improved cybersecurity.

Many thanks for your time, Val. We look forward to talking to you again next year.

1 Deal premiums are analyzed for M&A deals that are completed successfully.

Related Content

Matthew Wells

As Intralinks’ vice president, product marketing, Matt Wells is a key member focused on the development and go-to-market strategy for Intralinks’ M&A business which includes our virtual data room and deal lifecycle solutions. Matt joined Intralinks in 2012 upon the acquisition of PE-Nexus, a company he co-founded in 2010 that pioneered the concept of online deal sourcing and buyer identification. Before PE-Nexus, he was a vice president at Cross Keys Capital, a boutique advisory firm, where he focused on middle-market M&A transactions.