Limited Partners Want More Fund Manager Contact

8 February 2023Limited partners (LPs) are seeking more frequent communication and better analytics from their general partners (GPs), according to the 2023 SS&C Intralinks LP Survey of 200 global LPs. A third of LPs want more contact with their investment managers, and a quarter say better analytics can improve their relationship with GPs.

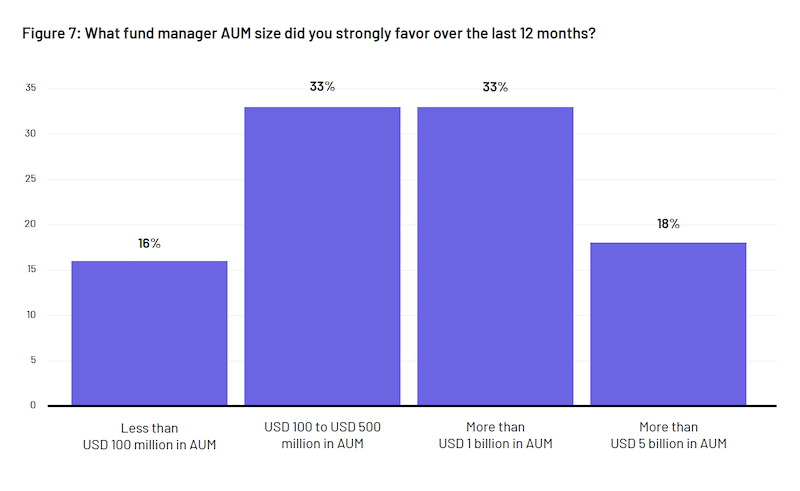

In the current fundraising environment, LPs are looking for more frequent conversations with their GPs. They are also showing a preference for fund managers who have between USD 100 million to USD 500 million or USD one billion to USD five billion in assets under management (AUM).

The 2023 SS&C Intralinks LP Survey, a newly published survey of 200 global LPs, reveals that a third of LPs want more contact with their investment managers. Additionally, a quarter of LPs say better report analytics can help improve their relationship with GPs.

When it comes to choosing funds to invest in, LPs are preferring fund manager AUM sizes in two ranges. According to the research, the USD 100 million to USD 500 million and USD one billion to USD five billion ranges are the fund size sweet spots for most investors, for both the last 12 months and the upcoming 12-month period.

Is bigger better?

The survey reveals that those looking for long-term inflation protection over the next couple of years are likely to seek more exposure to big brand asset owners that have a compelling infrastructure story to tell. These brands are raising record fund sizes of over USD 10 billion to cover LP demand and the capital required for projects addressing the world’s energy transition.

Meanwhile, emerging managers are gaining a foothold among LPs, though the process of selection is a challenge, according to placement agents. In the next 12 months, 29 percent of investors who took part in the survey said they are planning to seek out emerging managers for access to niche strategy options. They are also driven by attractive return potential (reported by just under 28 percent) and a desire to access new talent.

The allure of private equity

The preferred asset class LPs are to deploying capital to is private equity, with just under 33 percent of investors saying they would be looking for emerging managers in this space.

“While there may be [an] appetite to invest with emerging managers, that's probably going to be the hardest area to raise capital simply because people are having to make some very difficult choices and are prioritizing re-ups with proven managers who have long track records, in lieu of new relationships,” says Fiona Anderson Wheeler, managing director, investor relations at BC Partners.

Within private equity, the report identifies the debut of smaller infrastructure funds on behalf of GPs in this space. Many of these are multi-asset managers carving out a future for themselves in the core-plus arena.

The CEO of a European private equity investor targeting core-plus infrastructure opportunities adds: “Infrastructure remains resilient and less volatile and that’s what people want right now. Overall, demand for infrastructure is accelerating fundraising and asset rotation. Many funds are in the market because they do not want to miss the window.

To download the 2023 SS&C Intralinks Survey, click here.

Related Content

Meghan McAlpine

As Sr. Director of Strategy and Product Marketing for Intralinks, Meghan McAlpine is responsible for the go-to-market strategy and driving the growth of the company’s Alternative Investments solution, the leading communication platform for private equity and hedge fund managers and investors.

Prior to joining Intralinks, Meghan worked in the Private Fund Group at Credit Suisse. While at Credit Suisse, she raised capital from institutional and high net worth investors for domestic and international private equity firms.