Maximize Buy-Side M&A Returns with Intralinks

Intralinks works directly for your buy-side team – from deal sourcing through due diligence, pipeline management and post-merger integration.

Buyside Due Diligence

Corporate Development teams and Private Equity firms to move with speed and confidence on decisions about which deals to pursue. Now, buyers can accelerate the diligence phase of the deal lifecycle, leveraging artificial intelligence (AI) and machine learning to quickly centralize and organize and analyze seller information – aligned to the way your team works. An Intralinks exclusive, DealVision™ is purpose-built for participants on the buyside of a transaction, designed to match actual workflow needs and providing transparency into the deal team’s activity in real-time.

Deal pipeline management: Every second counts

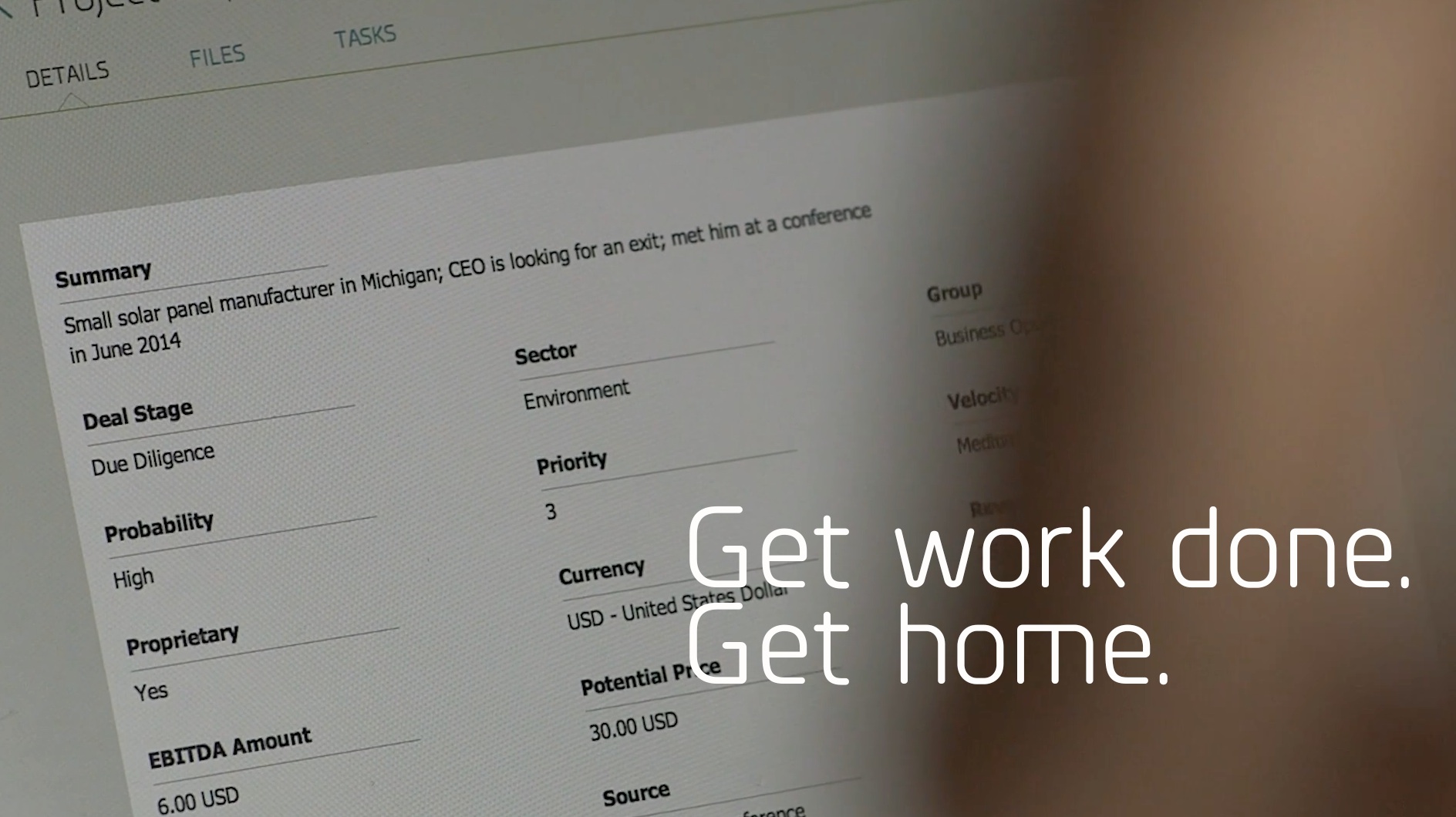

Corporate development teams are constantly reviewing acquisition targets while also driving ongoing transactions. Managing your deal pipeline requires a standardized process. With Intralinks DealManager, your deal team can catalog everything from teasers to closing documents in a secure and easily searchable repository – and monitor progress on all ongoing transactions through dashboards and reporting tools that provide real-time transparency.

Immediate pipeline visibility

The Intralinks Corporate Development Dashboard is a single, centralized location providing your deal team with improved visibility into your deal pipeline. Quickly review key summary data and financials on opportunities currently in the evaluation process or details about those reviewed in the past. Forget scanning through endless emails and spreadsheets — real-time information is just a click away.

Close deals faster

The Intralinks platform is used to facilitate over 7,000 liquidity events annually, and over $34.7 trillion in transaction value has passed through our platform. With industry-leading functionalities such as plugin-free protection of Microsoft Office files and PDFs, to ultra-fast data management through Intralinks Designer, Intralinks brings best-in-breed technologies and services to the capital markets. Use Intralinks Secure Mobile to review and manage data in your deal room anytime, from anywhere, even on the go, from your iPad or iPhone. Expedite due diligence and close deals quickly with secure access to your documents.

Institutionalize corporate memory through centralized repositories

The industry-leading Intralinks VDRPro Virtual Data Room features an auditable system of record for all your deals, providing corporate memory to retain and manage your critical deal information. Easily refer back to past data at any time to repurpose analyses and presentations for future purposes.

Post-merger integration (PMI)

Establish secure communications channels between integration teams with Intralinks. During M&A diligence and PMI, large, highly sensitive, and extremely confidential datasets are transferred and reviewed by multiple parties, so the chances of data “leakage” – intentional or unintentional – can be fairly high. Employing proper tools that can track all user activity, remote-wipe document access, and establish restrictive parameters around data activity are essential when dealing with M&A-related disclosures.