Credit Suisse

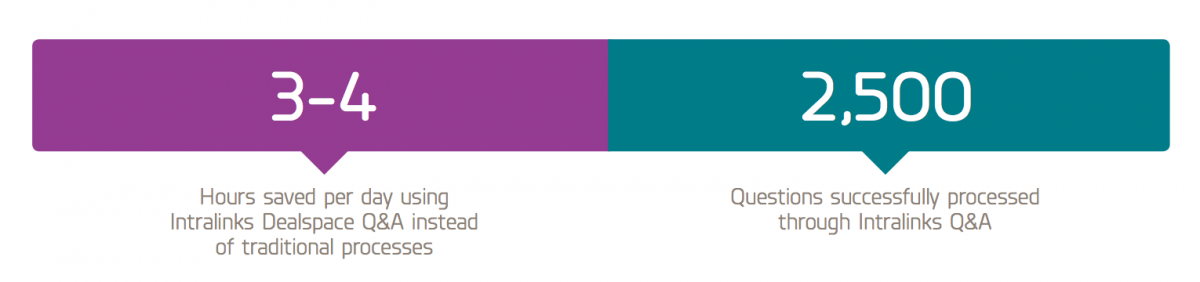

23 October 2015Credit Suisse saved significant time and accelerated M&A processes using the Q&A functionality of Intralinks.

About Credit Suisse

Credit Suisse is one of the world’s top M&A advisory groups, providing services to clients across a range of industries and countries. Its mergers and acquisitions team has broad expertise in acquisitions, corporate sales, divestitures, joint ventures, leveraged buyouts, mergers, privatizations, proxy contests, recapitalizations, shareholder activism, spin-offs/split-offs, takeover defense, and tax-advantaged structures. Whether advising on a multibillion-dollar merger or a $100 million divestiture, Credit Suisse brings innovation, experience, and capabilities to clients around the world. Its team is located across the Americas, Europe, and Asia Pacific and has special expertise in executing cross-border transactions.

Situation

Credit Suisse facilitates a large number of both buy-side and sell-side M&A deals every year. A key part of progressing through those deals is the high number of questions and answers (Q&A) that need to be exchanged between prospective buyers and sellers. This process can be extremely difficult to manage using traditional approaches, because all of the content must be tracked and secured. According to Justin Hales, M&A Investment Banking Analyst, Credit Suisse was using traditional methods to keep track of the hundreds of questions and answers in its M&A projects. This manual, time-intensive process resulted in extremely large spreadsheets that were difficult to manage and extended the diligence process. In addition, the Microsoft® Excel Q&A tracker would only be shared once a day, so when people missed one day’s “deadline,” their content could not be shared until the next day’s distribution, which caused delays in information sharing.

Solution

Seeking an alternative to its spreadsheet Q&A management process, Credit Suisse turned to Intralinks. Hales said that he was attracted to the ease of use of the Intralinks interface as well as its Q&A management functionality. Now, Intralinks is used on a daily basis at Credit Suisse and keeps its M&A processes – including Q&A – organized and running smoothly.

Benefits

Hales stated that Intralinks and its Q&A feature have streamlined the M&A process with its ease of use, and by enabling team members to share information more rapidly and complete deal processes in a more time-efficient manner. “The Intralinks Q&A functionality makes my life much easier. You can quickly see what questions have and have not been answered, and it allows our executives to stay on top of deal progress,” Hales commented. “Using Intralinks, I can give status updates and answer queries in real time. It also makes it easy to facilitate questions between different buyers.” Hales added that, from an auditing perspective, the Q&A feature is very helpful because teams can quickly and easily locate specific questions. “It’s a great tool for relieving our teams from mundane administrative tasks, so they can focus on increasing deal velocity,” he said.