Deal Marketing for Banking

and Capital Markets Transactions

Organize, accelerate and track distribution of debt securities offering materials and open a clear path to investors – fast.

Intralinks is streamlining the painstaking deal marketing process in debt capital markets. We’re eliminating reliance on spreadsheets and guesswork, so you can identify your best investors quickly and fast-track your deal.

Use our Deal Marketing platform to:

- Simplify deal document organization, distribution and storage

- Conduct a virtual roadshow

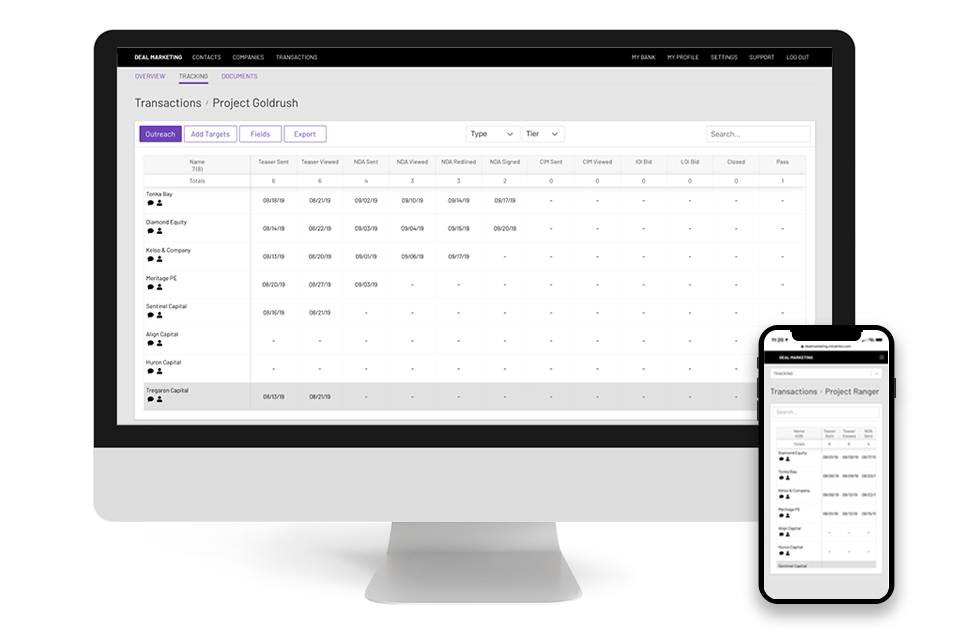

- Track activity and gauge investor engagement

- Transition seamlessly and securely to due diligence

Get in touch to find out how Intralinks can improve the way you take your deals to market.

How does Intralinks’ high-performance DealMarketing™ drive the best deals on the map? Watch this quick video for a look under the hood.

Here’s how it works

1

Create a new deal to market

2

Send the investor presentation and other materials in one go

3

Allow recipients to view files immediately

(virtual roadshow: check!)

4

Track investor engagement, activity and commitments … then move on to due diligence

Intralinks is the most comprehensive platform for the asset-backed securities (ABS) and debt capital markets, featuring:

- Best-in-class virtual data room (VDR): Modern, fast, intuitive, easy-to-use platform with insightful reporting and workflow tools

- Virtual roadshows: Get investor presentation in front of investors immediately; allow them to view files within the platform – no download or access to VDR necessary

- 17g-5 compliance: Designed for issuers, sponsors, underwriters, NRSROs to meet SEC Rule 17g-5 requirements

- Uncompromised security: Data encryption in-transit and at rest; granular permissioning; document retraction and redaction

- Compliance reporting: Extremely detailed audit, user activity and document access reports

- Award-winning customer service: Global, 24/7/365 support in 140 languages

Ready to take the deal on the (virtual) road? Intralinks goes the extra mile with a roadshow solution that provides:

- Real-time analytics: Gauge investor interest easily through up-to-date statistics on who viewed the presentation and for how long, and which parts are piquing their interest

- Investors at the ready: Build on investor lists from previous transactions and avoid wasting valuable time chasing uninterested investors

- Bookbuilding: Capture investment commitments, manage NDAs and NPAs, and get a head start on the bookbuilding process

- Insight into the future: Intralinks distills data from previous transactions – investors most interested in particular deal types, typical commitments, and more – to help deal teams inform their success in future ones